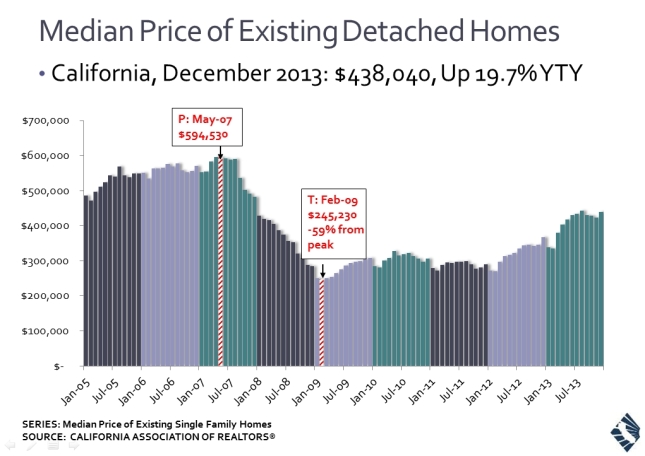

It is a challenging thing to try and predict just exactly where the Real Estate market is heading. The chart above reflects the California median home price for detached homes from its peak in May 2007, its low point in Feb. 2009, and the fairly steady recovery to date (at least through December 2013). We have a long way to go before we make up the full loss (59%) in home values (some local markets fared slightly better,) but I am still confident that there is a light at the end of the tunnel and it’s not a train!

A recent California Association of Realtors (C.A.R.) report (released on February 26, 2014) that provides data on January home sales, shows a slight increase in housing inventory and a reversal of a two month decline in pending sales as we prepare to enter the spring home buying season. This is good news since there was a considerable amount of concern that the market had stalled toward the end of 2013 because of the slowdown in pending sales coming in to the New Year. With a slight drop in the 30 year fixed mortgage rate to 4.28% (15 year fixed rate is currently 3.32%) and stabilized home prices, the signs of a good robust spring/summer home selling market appears now to be heading in the right direction for both buyers and sellers.

The huge upward price swing in home values during the first 3 quarters of 2013 was the result of investors, move up buyers and first time homebuyers all competing over the same slice of pie. This caused a rather abrupt increase in home values but with an economy that didn’t produce the jobs and or salaries to match that upswing, things just tapered a bit. In addition new housing construction has yet to provide additional inventory choices to the consumer. Once those homes start coming on the market then it should open up several more options as well.

I believe that things should start to improve in the spring/summer months of this year and we are already seeing signs of increased active listings and new pending sales toward the end of February. With interest rates remaining low and sellers considering their options, things could heat up rather fast and whether you are buying or selling you should be tracking these changes with your Realtor.

Some of the other statistics that California Association of Realtor researchers found out in their recent Home Buyer and Home Seller Surveys are that home sellers are more optimistic about the market and expect it to improve in this next year. Many of those homeowners said they plan to take advantage of their home equity by selling and moving up to another home. In addition buyers are of the opinion that the Real Estate market is a very sound investment. This is very good news for all!

Written by Mike Southwick – use by permission only